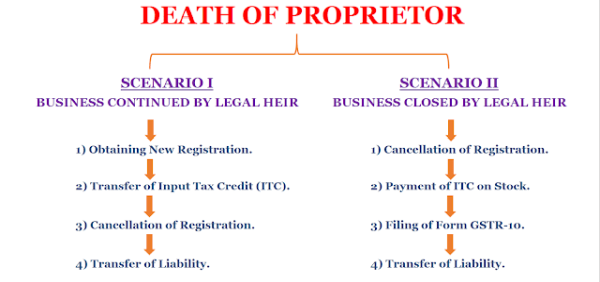

When a business is transferred to another person for any reason—including the death of the proprietor—the transferee or successor, as the case may be, shall be required to be registered with effect from the date of such transfer or succession. The applicant must specify “death of single owner” as the cause for obtaining registration when submitting an application in Form GST REG-01 electronically using the common GST portal.

Transfer of Input Tax Credit and Tax Liability

If a sole proprietor dies and the business is continued by a transferee or successor, it will be seen as a transfer of the business.

According to Section 18(3) of the CGST Act, when there is a specific provision for the transfer of liabilities, the registered person may transfer the unused input tax credit that is shown in his electronic credit ledger to the transferee in the manner specified in Rule 41 of the CGST Rules.

According to Section 93(1) of the CGST Act, if a person who is responsible for paying tax, interest, or penalties under the CGST Act passes away, the person who continues his or her business will be responsible for paying any tax, interest, or penalties owed by that person under this Act.

Furthermore, it is made clear that, in cases of business transfers resulting from the death of a sole proprietor, the transferee or successor shall be responsible for paying any taxes, interest, or penalties due from the transferor.

How to Transfer Input Tax Credit to Successor

The input tax credit that is still unutilized in the computerized credit ledger is permitted to be passed to the transferee in the event of the death of a single proprietor if the business is continued by any person acting as transferee or successor.

What is the Manner of Transfer of Credit?

In the event of a sale, merger, de-merger, amalgamation, lease, transfer, or change in ownership of a business for any reason, a registered person shall file Form GST ITC-02 electronically on the common portal with a request for the transfer of unutilized input tax credits lying in his electronic credit ledger to the transferee.

When a sole proprietor’s business is transferred due to his or her passing, the transferee or successor must submit Form GST ITC-02 for the registration that needs to be canceled as a result. The transferee or successor must submit Form GST ITC-02 before submitting an application to cancel the registration. The unutilized input tax credit listed in Form GST ITC-02 must be accepted by the transferee or successor before being credited to his electronic credit ledger.

A transfer or change in ownership of a business would include a transfer or change in ownership due to the death of the sole proprietor for the purposes of Sections 18(3), 22(3), and 85(1) of the CGST Act and Rule 43(1) of the CGST Regulations.

Cancellation of GST Registration due to a Sole Proprietor’s Death

Cancellation of GST Registration on account of transfer of business for any cause, including the death of the proprietor, is covered by Section 29(1)(a) of the CGST Act, 2019. The legal heirs of a deceased single proprietor of a firm may submit an application for cancellation of registration in Form GST REG-16 electronically on the common platform, according to Section 29(1)(a) of the CGST Act. The reason for the cancellation must be listed as “death of single proprietor” on Form GST REG-16. The transferee is needed to upload the proprietor’s death certificate when filing for cancellation.

To link the GSTIN of the transferor and the GSTIN of the transferee, the GSTIN of the transferee to whom the business has been transferred must also be provided.

Income Tax Compliance After the Death of a Sole Proprietor

According to Section 159 of the Income Tax Code, the spouse, legal representative, or executor is responsible for completing the income tax return and paying off any outstanding tax debts of the deceased assessee if they pass away tragically before doing so for any year in which filing is required. Although a deceased individual is eligible for all deductions and exemptions for the whole year, only the income earned up until their death is subject to tax. The income would thereafter be taxable in the hands of the legal heir and included in his return of income.

The return of the deceased, however, would only include income up until the date of the assessee’s death. The assessee’s lawful heirs receive both the income from his or her assets and the tax debt upon his or her death. Thus, the legal heir is now responsible for filing tax returns. This indicates that the legal heir may file tax returns on the decedent’s behalf.

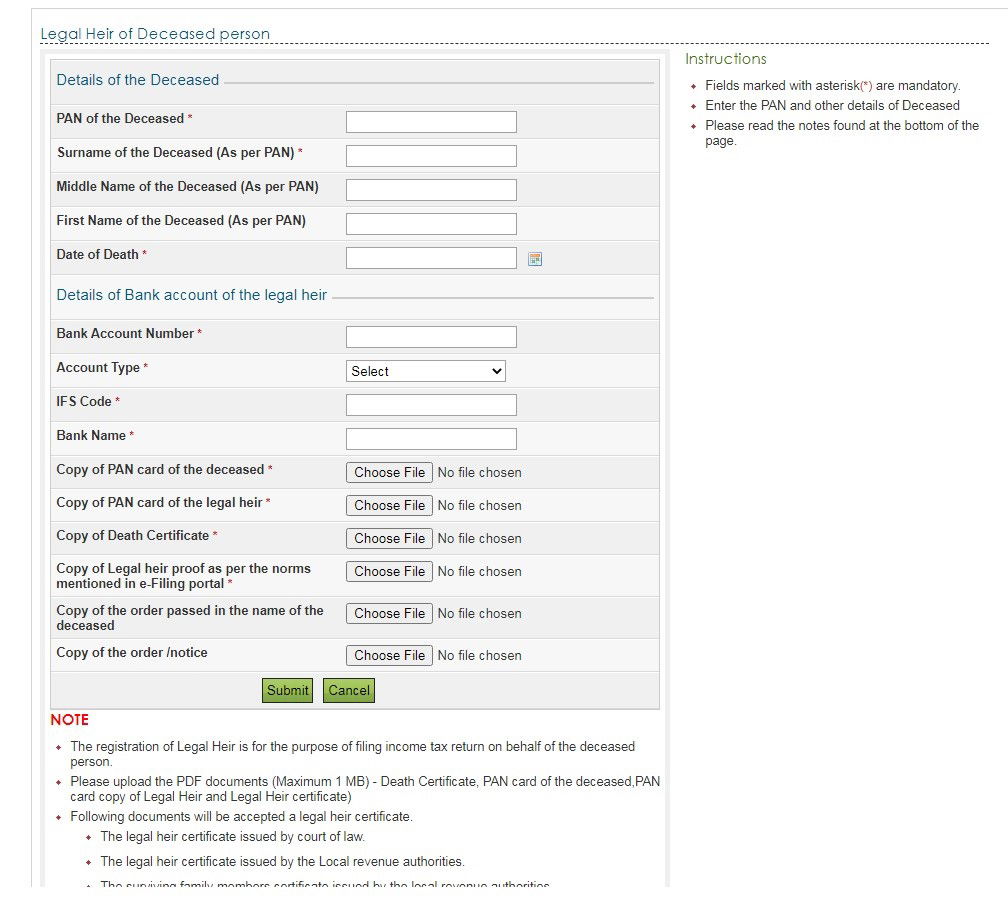

The following steps must be followed in order to register as a legal successor on the e-filing website in the event that the assessee passes away. The legal heir must also file the return on the assessee’s behalf.

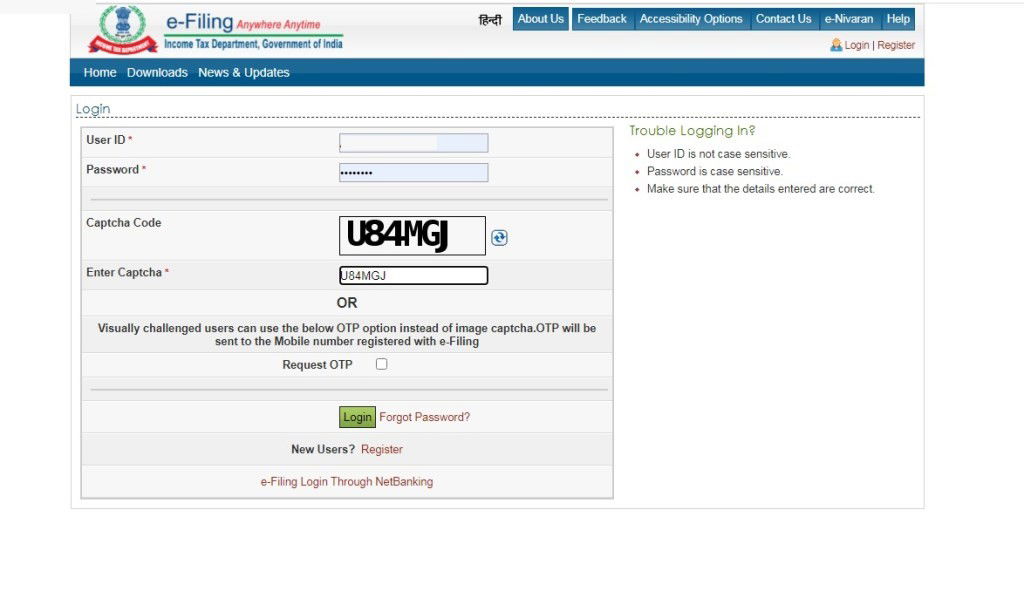

Step 1: Use your personal login information, such as legal heir, to access the “e-Filing” section of the Income Tax India website.

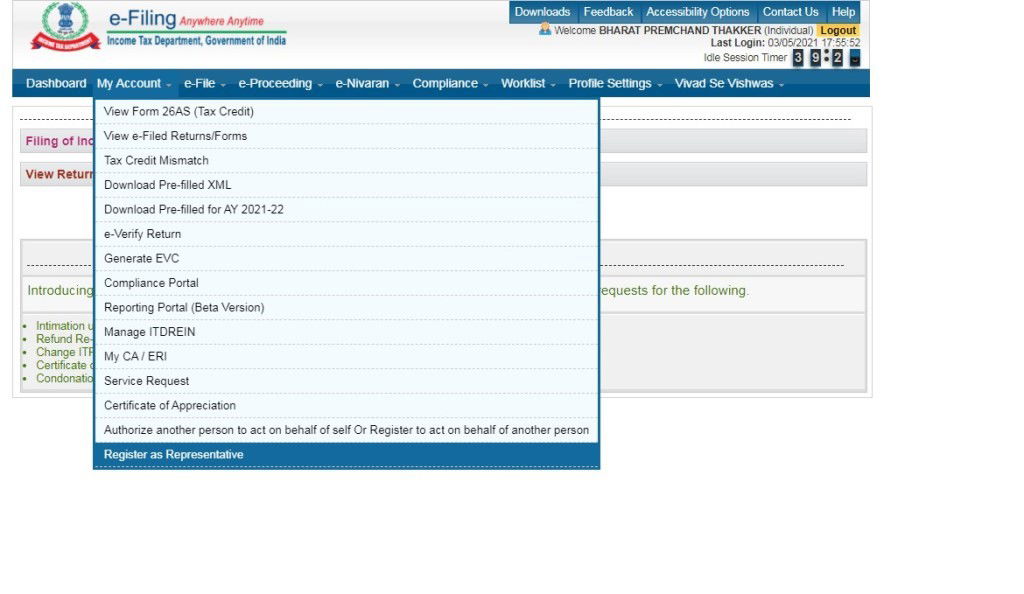

Step 2: Next, select the “Register as Representative” option under the “My Account” page.

A redirect will take you to the “Register as Representative” page.

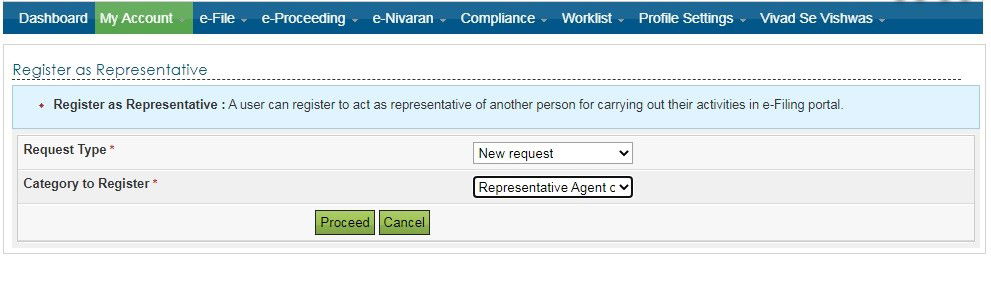

Step 3: Next, use the “Proceed” option after selecting the “Deceased (Legal Heir)” category and the “New Request” request type.

Step 4: Now enter the information below:

- The deceased’s PAN

- Name and birthdate of the deceased according to PAN

- Bank information for the legal heir

- Upload the necessary files

Click the “Submit” button after filling out and uploading the aforementioned information. Upon the submission of the Register as an authorized signatory request, a success message will be shown. The e-Filing Admin will receive the request and approve it. An email and SMS will be issued to the user who submitted the request when the e-Filing Admin has verified the request’s legitimacy and has the option of approving or rejecting it.

Note

- In order to file an income tax return on behalf of the deceased person, the legal heir must register.

- Upload the following files in PDF format (maximum 1 MB):

- Certificate of death

- The deceased person’s PAN card

- Copy of the legal heir’s PAN card and

- Certificate of legal heir

- The following documents will be accepted as a legal heir certificate:

- The court-issued legal heir certificate

- The local revenue authorities’ legal heir certificate

- The local revenue authorities’ certificate for surviving family members

- The legally binding will

- The State or federally-issued Family Pension Certificate

- A letter stating the name of the nominee or joint account holder for the deceased at the time of death, issued by the banking or financial institution on its letterhead with its seal and signature

- To submit the legal heir certificate and the will’s Hindi/English translation. accompanied with a copy of the original certificate, suitably notarized

Conclusion

In this section, we quickly review the process of transferring an input tax credit in the event of a sole proprietor’s death as it has been described thus far in this blog.

When a sole proprietor passes away and the transferee or successor wishes to carry on with the business, a question regarding the transfer of unused input tax credits that are stored in the electronic credit ledger of the deceased proprietary firm will arise because, in accordance with Section 41(1)’s procedure, the transferor is required to file the Form GST ITC-02.

The list of relevant sections and regulations is as follows:

- The Central Goods and Service Tax Act, 2017, Section 18(3)—Transfer of Unused Input Tax Credit Lying in the Transferor’s Electronic Credit Ledger; and

- The process to be followed for the transfer of the unused input tax credit is outlined in Rule 41 of the Central Goods and Service Tax Regulations, 2017.

Steps a Transferee Must Take

- The transferee or successor must submit an application in the form GST REG-01 in order to obtain a GST registration.

- The transferee or successor must specify “death of the proprietor” as the reason for seeking registration when submitting the registration application in Form GST REG-01.

- When a sole proprietor’s business is transferred due to his or her passing, the transferee or successor must submit Form GST ITC-02.

It is significant to note that the transferee or successor must submit Form GST ITC-02 before submitting an application to revoke the deceased proprietary firm’s GST registration.

The unutilized input tax credit as stated in Form GST ITC-02 shall be credited to the electronic credit ledger of the transferee or successor upon acceptance by the transferee or successor, who is required to accept the same.

- The legal heirs must submit Form GST REG-16, Application for Cancellation of GST Registration of Deceased Sole Proprietary Firm, with their application.

- The “death of the sole proprietor” must be stated as the basis for the cancellation of registration when submitting Form GST REG-16 to request cancellation of registration.

To ensure that the GSTIN of the transferor and the GSTIN of the transferee match, an additional GSTIN of the transferee (obtained by filing for a new GST registration; see step 1 above) must be provided.

Based on what we’ve covered so far, we believe that this blog will be helpful to any readers who are interested in learning how input tax credits are transferred in the event that a single proprietor passes away.

If you are a sole proprietor or a family member of a deceased sole proprietor, it is crucial to understand the process of transferring input tax credit in case of death. Failing to do so may result in the loss of significant tax benefits and could result in legal consequences.

Post Disclaimer

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxchanakya has exercised reasonable efforts to ensure the veracity of information/content published, Taxchanakya shall be under no liability in any manner whatsoever for incorrect information, if any.